|

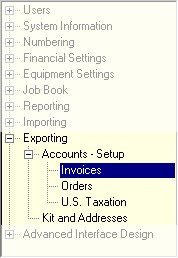

Exporting Invoices

|

|

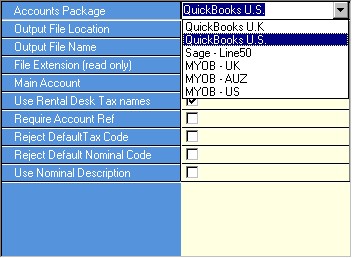

| Output File Location | This is where on your computer you would like the export file to be created. If you are exporting on several computers, it is a good idea to have the same location created on all your machines. (i.e. C:\RentalDesk Export)

|

|

|

| Output File Name | This is the name of the file to be created when the export is created. It is possible to create a file name which will embed the date/time of the export so that you will not overwrite previous exports. To do this, you must uses the following format in the export filename field:

|

| {yy} - stores the year of the export in 2 digits

|

| {yyyy} - stores the year of the export in 4 digits;

|

| {m} - stores the month of the export without a leading zero

|

| {mm} - stores the month of the export with a leading zero

|

| {d} - stores the day of the export without a leading zero

|

| {dd} - stores the day of the export with a leading zero

|

| {h} - stores the hour of the export without a leading zero

|

| {hh} - stores the hour of the export with a leading zero

|

| {n} - stores the minute of the export without a leading zero

|

| {nn} - stores the minute of the export with a leading zero

|

| {s} - stores the second of the export without a leading zero

|

| {ss} - stores the second of the export with a leading zero

|

|

|

| Example: {mm}{d}{yy} - {h}{n}{ss} would be saved as 01104 - 104532.*

|

|

|

| A file name can be up to 100 characters long (the programme doesn't count the curly brackets. The export file name will store date and time field elements in the order you enter them.

|

|

|

|

|

| File Extension (read only) | The file extension is chosen automatically depending on which Accounts Package you have chosen.

|

|

|

| Main Account | This is the account which the information will be exported and is not used by Sage or MYOB. For QuickBooks, this will probably be your accounts receivable.

|

|

|

| Use RentalDesk Tax Names | Checking this will mean that the tax codes configured in RentalDesk will be used when exporting. If you have configured your tax codes to match the tax codes of your accounting system, then this can be used. For QuickBooks US, you may want to read this.

|

|

|

| Require Account Ref | This is used to force the system to use the account reference, which is setup in the address book.

|

|

|

| Reject Default Tax Code | A job picks up the tax code assigned to a Customer in the Address Book. If you have not see this explicitly the default (first) tax code is used, which may be incorrect. If you want the export log to warn you that items with the first tax code are being exported then check this option

|

|

|

| Reject Default Nominal Code | A job picks up the nominal code assigned to a piece of equipment in the equipment book. If you have not see this explicitly the default (first) nominal code is used, which may be incorrect. If you want the export log to warn you that items with the first nominal code are being exported then check this option

|

|

|

| Use Nominal Description | Tick this box if you wish to use the alphanumeric nominal description instead of the nominal code.

|

|

|

|

|