|

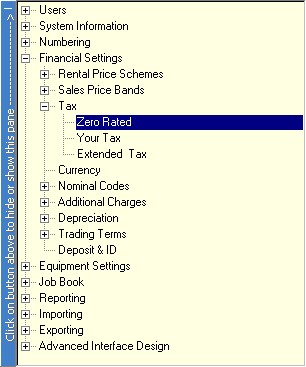

Tax

|

|

| Additive [a+b+c]% | All the 3 tax rates are added together and that is then applied to the invoice.

|

| Example: On a $100.00 item the tax will be $7.50

|

|

|

| Cumulative [a]%,[b]%,[c]% | Each tax will be applied individually in turn on the total including tax.

|

| Example: On a $100.00 item the tax will be

|

| 1% of $100.00 = $1.00

|

| +6% of $101.00 =$6.06

|

| +.5% of $107.60 =$.54

|

| Giving a total tax of $7.60

|

|

|

| AddCumu [a+b]%,[c]% | The first two tax rates are added and the last tax rate is then applied on the total.

|

| Example: On a $100.00 item the tax will be

|

| 1% + 6% of $100.00 = $7.00

|

| +.5% of $107.00 = $. 54

|

| Giving a total tax of $7.54

|

|

|

| AddCumu [a]%,[b+c]% | The first tax rate is applied, then the sum of the last two tax rates is applied on the total.

|

| Example: On a $100.00 item the tax will be

|

| 1% of $100.00 =$1.00

|

| 6% + .5% of $101.00 = $6.57

|