Name

|

How to Configure

|

Notes

|

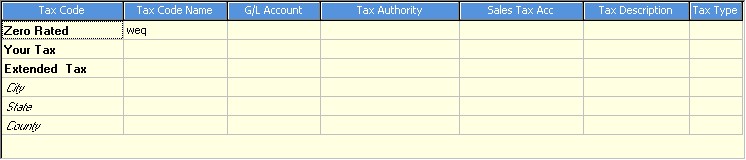

Tax Code Name

|

Refer to your QUICKBOOKS taxcodes

|

RentalDesk Main Tax Codes can only be up to 5 characters long, so you will need to enter the your QUICKBOOKS tax code name here. Don't forget a "dummy" account for Composite (Group) Tax Codes

|

|

|

|

G/L Account

|

Not applicable

|

Leave blank

|

|

|

|

Tax Authority

|

Refer to your QUICKBOOKS taxcodes

|

Enter the Tax Authority who collects this tax EXACTLY as it is spelt in QUICKBOOKS

|

|

|

|

Sales Tax Account

|

This defaults to Sales Tax Payable in all the versions of QB that we have tested and cannot be changed

|

You need to specify this for EVERY tax code in RentalDesk

|

|

|

|

Tax Description

|

Refer to your QUICKBOOKS taxcodes

|

Enter the Tax Description in QUICKBOOKS EXACTLY as it is spelt

|

|

|

|

Tax Type

|

Not applicable

|

Leave blank

|