Finance Defaults

The Finance Default settings allows a user to specify whether the financial settings of the job will use the Client or the Venue for all financial documents such as the Tax Address and Invoices.

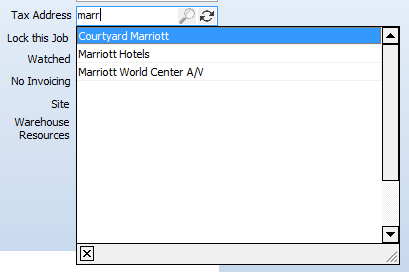

Tax Address

The Tax Address determines the correct tax to be charged on the based on the default tax settings for a company as configured in the Accounts Book Setup Page.

Your tax requirements will be dependant on laws in your country and your province or state.

If no tax codes have been assigned to a company, then HireTrack will use the system default tax assigned in the Configuration Book on the Rules Page.

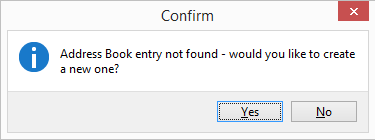

If the company does not exist in your address book, you will be prompted to enter the company information into the HireTrack NX Address Book.

Note: The fields highlighted in red indicate a required field and data must be entered in these fields to continue. These requirements are set in the rules tab of the HireTrack NX Configuration Tab.

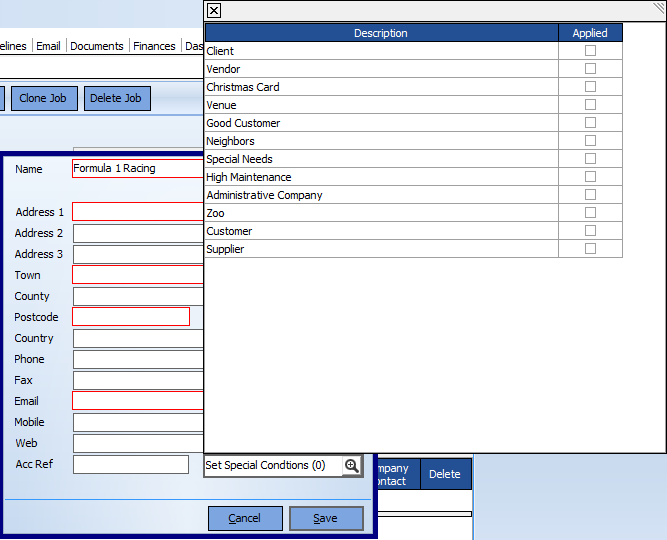

If needed, you can also set Special Conditions, which have been configured in the Address Book Company Special Page.